- Vipin Malik is the Chairman & Mentor of Infomerics Ratings While Sankhanath Bandyopadhyay is the Economist of Infomerics Ratings.

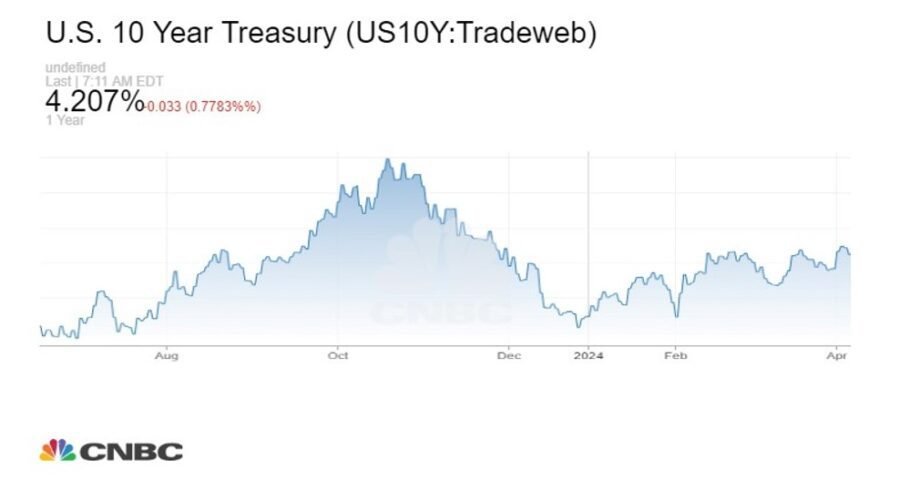

Despite the decline in the Headline CPI in US to 3.3% YoY from 3.4% and the decline of the core inflation to 3.4% YoY from 3.6%, the Fed kept the Federal Funds Rate (FFR) unchanged. The rate softening possibility has shifted to the month of September (2024) now. If disinflation continues according to the Fed’s 2 per cent target, then there could be chances of two rate cuts in this year. Nevertheless, this is a matter of crossing fingers’, since the previous market expectation of three rate cuts in 2024 yet not materialised. Moreover, the global political and economic environment remains highly volatile. The Fed has estimated the GDP growth at 2.1% for Q4 2024 and 2.0% for both Q4 2025 and Q4 2026. However, PCE inflation estimates were revised up for Q4 2024 and Q4 2025 to 2.6% (vs. 2.4%) and 2.3% (vs. 2.2%).

Amid other notable global developments, the Bank of Japan (BOJ), while expressing about the reduction of their bond buying programme, declined to provide details before July’24 meeting.

The BOJ kept rates unchanged at (0.00-0.1%). The Japanese yen faced downward pressure; the USD/JPY pair depreciated to 157.84. It also falls against the Singapore dollar. The US 10-yr yield shows some softening on 14 June’24, at 4.20% (-0.03%).

According to the data by the Bank of England’s Sterling Overnight Index Average (SONIA), banks are paying more to attract liquidity. Also, the short-term repo facility use rose sharply and will likely continue increasing. The sudden tightening of liquidity conditions is a warning for the eurozone, where such a tightening could have a more profound impact on rates.

In line with the market expectations, the People’s Bank of China kept the one-year medium-term lending facility rate unchanged at 2.5%. The credit activity remains weak amid the RMB 819.7 billion of new RMB loans as well as RMB 2.06tr of new aggregate financing.

The real cost of borrowing remains high, whereas the loan demand remains insufficient to stimulate the economy. China’s property market slowdown continues, with both new and used home prices remain subdued.

According to the ING research, out of a seventy-city sample, only two cities (Shanghai and Taiyuan) saw an increase in prices in May’24 for new homes, while none saw an increase in the secondary market. Real estate investment declined to (-)10.1% Year-on-Year (YoY) Year-To-Date (YTD) in the first five months of the year, down from -9.8% YoY YTD in the first four months of the year.

Another challenge is that the European Union (EU) would likely to impose hefty tariff (could go up to 38%) on Chinese electric vehicles (EVs) as it sees there is a flood of cheap government subsidised Chinese cars in the trade bloc. However, China’s retail sales have increased substantially compared to the consensus estimate.

India’s retail inflation eased to 4.75 per cent on an annual basis in May’24 as against 4.83 per cent in the previous month. The RBI in its June’24 monetary policy. has kept the repo rate unchanged at 6.50 per cent in its June monetary policy. However, interestingly this time dissent among the MPC members have increased by 4:2 compared to previous 5:1, indicating ceteris paribus, possible forthcoming changes in either rate or stance or both in the next monetary policy. The details will be unfolded when the details pertaining to the monetary policy minutes would be published.

Based on the encouraging real GDP growth rate of 8.2 per cent in FY 2023-24 as compared to the growth rate of 7.0% in FY 2022-23, the real GDP growth projections have been enhanced upwards by the RBI. Real GDP growth for 2024-25 is projected at 7.2 per cent (enhanced from 7.0 per cent from the previous projection) with -Q1 at 7.3 per cent (enhanced from 7.1 per cent earlier); Q2 at 7.2 per cent (enhanced from 6.9 per cent); Q3 at 7.3 per cent (enhanced from 7.0 per cent); Q4 at 7.2 per cent (enhanced from 7.0 per cent).

On the other hand, while admitting that core inflation is reducing and well range-bound, the RBI has expressed concerns about the volatility of the food inflation. The exceptionally hot summer season and low reservoir levels may put stress on the summer crop of vegetables and fruits. The rabi arrivals of pulses and vegetables need to be carefully monitored. Hence, assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent.

According to the World Bank’s June’24 Global Economic Outlook, global growth is projected to stabilize at 2.6 percent this year despite geopolitical tensions and high interest rates. It is then expected to edge up to 2.7 percent in 2025-26 amid modest growth in trade and investment.

Global inflation is projected to moderate, but at a slower pace than previously assumed, averaging 3.5 percent this year. Given continued inflationary pressures, central banks in both advanced economies and emerging market and developing economies (EMDEs) will likely remain cautious in easing monetary policy. As such, average benchmark policy interest rates over the next few years are expected to remain about double the 2000-19 average.